Introduction

The Residential Tenancies Board (RTB) recently published a new data series which provides information on all private and Approved Housing Body (AHB) tenancies registered with the RTB from Q2 2023 onwards. The RTB is an independent, public body that is responsible for registering tenancies and ensuring compliance in the private rental sector (PRS). This blog explores the ‘Profile of the Register Data’ and sets out some important considerations which should be kept in mind when interpreting the data.

Registration Requirements

Before delving into the data, it is important to understand the requirements for registering tenancies in the PRS. Under the Residential Tenancies Act, landlords must register new tenancies with the RTB within a month of the tenancy starting. As of April 2022, landlords must also re-register the tenancy every year that it continues. This additional requirement has provided more in-depth information on the Irish rental sector than previously available.

Key Findings

Private Rental Sector Tenancies

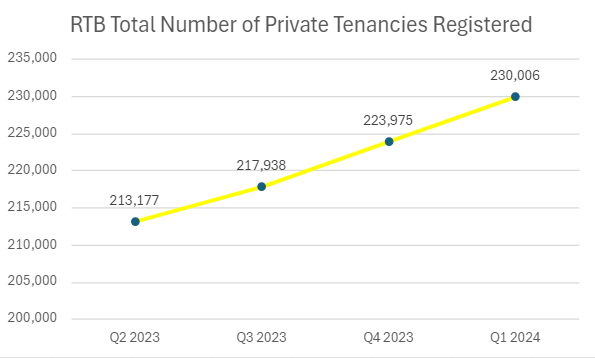

The number of tenancies registered with the RTB increased every quarter since Q2 2023, rising from 213,177 to 230,006 in Q1 2024 – an increase of 7.9%. 4 out of 5 (81%) tenancies were in rent pressure zones. 52% of tenancy registrations were for houses and 48% were for apartments. 2- and 3- bedroom properties were the most common dwelling sizes, accounting for 155,196 tenancies.

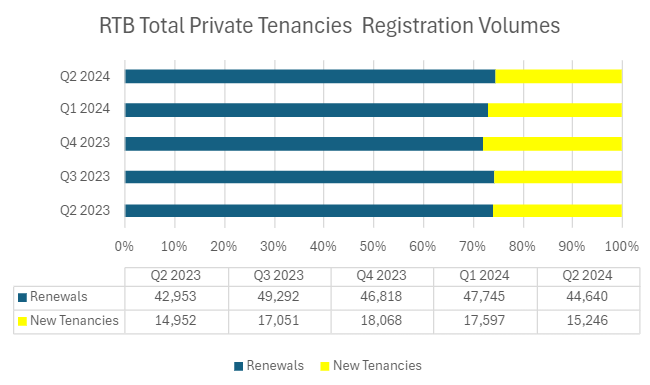

Most of the tenancies registered were renewals. Between Q2 2023 and Q1 2024, there were a total of 231,448 tenancies renewed and 82,914 new tenancies registered.

Private Landlords

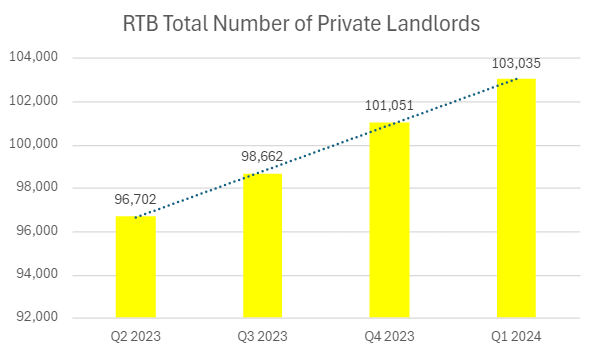

The number of private landlords has also increased every quarter since Q2 2023, rising from 96,702 to 103,035 in Q1 2024. The proportion of tenancies associated with large landlords, responsible for 100+ properties, has increased from 9.35% in Q2 2023 to 11.17% in Q1 2024. Large landlords are concentrated in Dublin, accounting for 1 in 5 (22.55%) of tenancies. Outside of Dublin, large landlords account for just 2.56% of tenancies.

Small landlords, responsible for 1-2 properties, account for 38.71% of tenancies. This is down slightly from Q2 2023, when small landlords accounted for 39.52% of tenancies. There has been considerable commentary in recent years in relation to landlords, particularly small landlords, leaving the rental market. This data indicated that although smaller landlords are leaving the rental market, it may be less pronounced than previously anticipated. We do know from RTB data on notices of terminations (eviction notices) that the main reason for landlords serving an eviction notice is due to the landlord intending to sell their property. Of the 27,856 eviction notices served since the start of 2023 (up to Q2 2024), 16,531 (59%) are due to the landlord intending to sell the property.

Budget 2024 introduced measures aimed at keeping landlords in the market. Tax relief of 20% was introduced in 2024, disregarding rental income of €3,000 for 2024, rising to €4,000 in 2025, and €5,000 in 2026 and 2027, provided that the landlord remains in the market for the four-year period. This may have had an impact on small landlords leaving the market.

Key Considerations

We urge caution in coming to any broad assumptions or conclusions at this early stage in the data set. Although it is positive to see a rise in the numbers of tenancies and landlords, levels remain much lower than in previous years. For example, at the end of 2020, the RTB recorded 297,837 tenancy registrations, with 165,736 private landlords. We note that this data is not directly comparable with the latest dataset, however it is worth noting that it shows a significant reduction in the number of both tenancy registrations and landlords in the PRS.

There have been a number of developments in the PRS which are important to consider when interpreting the new dataset. If landlords do not register their tenancies on time in accordance with legislation they are charged late fees. The RTB placed a temporary pause and issued refunds of late fees for tenancies which were due for registration between the 12th of November 2022 and the 1st of March 2024. This is due to issues landlords were having registering their tenancies. It is possible that some of the upswing in tenancy registrations reflects these issues being resolved, and the recommencement of late fees.

Another important caveat when interpreting the data is the findings from Census 2022 where 330,632 households indicated that they rented their homes from a private landlord. This differs significantly from the 246,453 RTB figure for the number of private rented tenancies registered with them at the end of 2022. The CSO and RTB have since completed a research paper exploring this discrepancy, which concluded that the original difference of 84,179 between the datasets can be reduced to 73,002 when properties in the rent-a-room scheme, properties owned by local authorities, and dwellings in which more than one household were recorded in the Census are excluded. The analysis found that 65% of the 73,002 households had informal rental arrangements, while 35% had formal rental arrangements which were not registered with the RTB. These properties are therefore not included in the RTB’s dataset, so we are unable to track the trajectory of these unregistered private rental properties and the landlords responsible for these properties.

Conclusion

The increased availability of data on the PRS provided by the RTB is very welcome. This over time will enable a better understanding of the sector and provide for more informed policies.

Despite some signs of growth in supply, we would urge caution in coming to any broad conclusions so early in the introduction of this new data set. An important observation from the perspective of the Simon Communities, as reflected in our quarterly Locked Out of the Market reports, is that an increase in supply does not see an increase in affordability. Our latest Locked Out report recorded an increase in the number of homes available to rent since a mid-2022 low. However, this has not coincided with an increase in the number of properties available within prescribed HAP limits.